Tax Brackets 2025 Married Jointly Over 65. The 2025 tax year standard deductions will increase to $29,200 for married couples filing jointly, up $1,500 from $27,700 for the 2025 tax year. The 2025 standard deduction amounts are as follows:.

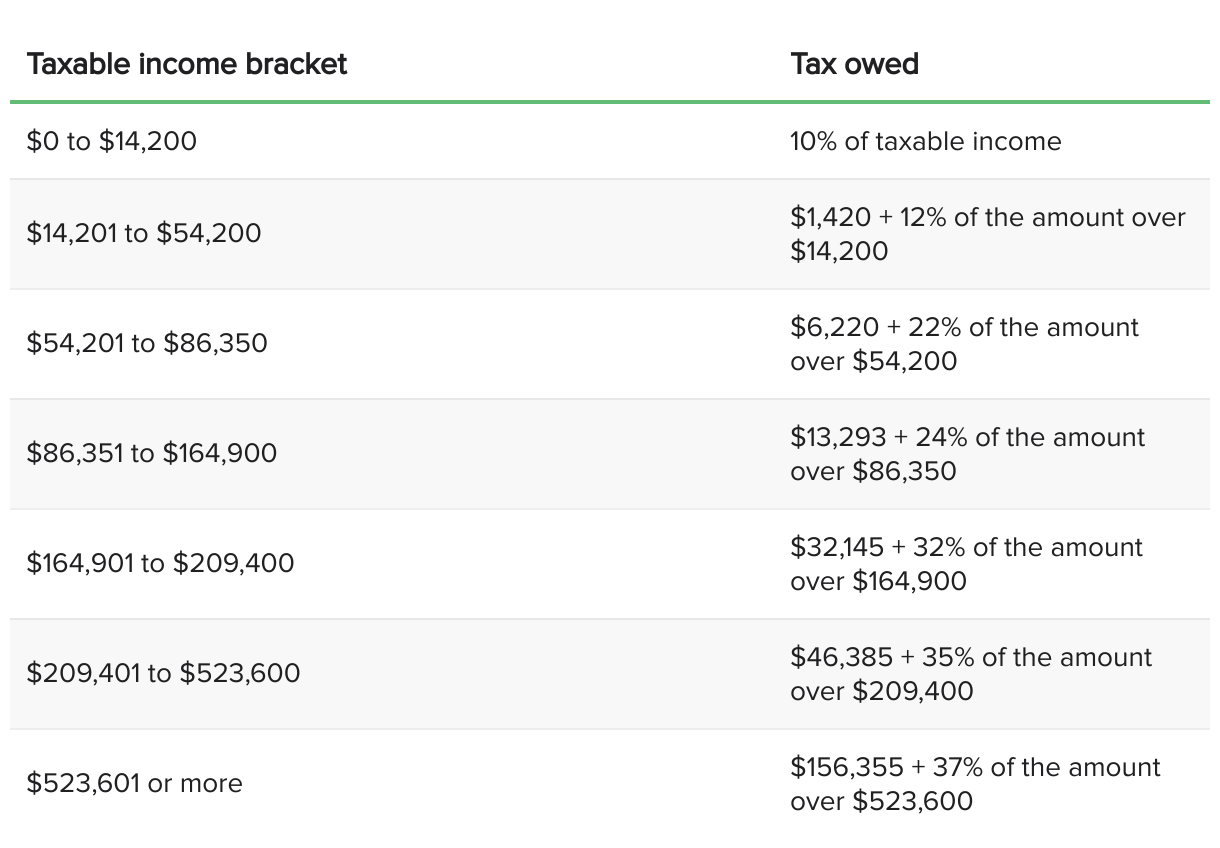

Rate married filing jointly single individual head of household married filing separately; Tax rate taxable income (single) taxable income (married filing jointly) 10%:

For the tax year 2025, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly).

Tax Brackets 2025 Married Jointly Over 65 Sonia Eleonora, The seven federal income tax brackets for 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. For single filers for the 2024 tax year, up from $13,850 for 2025.

Tax Brackets 2025 Married Jointly Over 65 Julia Ainsley, 2025 standard deduction over 65 tax brackets elvira miquela, if you are a single senior over the age of 65, you can claim an additional standard deduction of $1,950, married. 10%, 15%, 25%, 28%, 33%, 35%, and 39.6%.

Tax Brackets 2025 Married Jointly Over 65 Elyse Imogene, Standard deduction for age 65 and over. Over the age of 65, the.

Tax Brackets 2025 Married Jointly Over 65 Clare Desirae, 35% for single filers with incomes over $243,725 and for married couples filing a joint tax return with incomes. For 2025 (tax returns typically filed in april 2025), the standard deduction amounts are $14,600 for single and for those who are married, filing separately;.

Irs Tax Bracket Married Filing Jointly 2025 Carlen Kathleen, If permissible by their plan, will be able to carry over up to $640 into the next. Standard deduction for age 65 and over.

2025 Tax Brackets Married Jointly Tax Brackets Torie Valentine, Federal income tax rates for tax years 2025, 2026 and 2017 and tax brackets. What are the 2025 tax brackets and federal income tax rates vs.

Standard Deduction 2025 Age 65 Shani Melessa, Based on your annual taxable income and filing status, your tax. Married filing jointly 2025 tax brackets.

2025 Tax Brackets Married Jointly Quinn Carmelia, Married filing jointly, both age 65 and over: For the tax year 2025, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly).

2025 Tax Brackets Married Filing Separately Married Filing Adele Antonie, The seven federal income tax brackets for 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%. Over the age of 65, the.

2025 Tax Brackets Married Jointly Proportional Josy Theadora, Federal income tax rates for tax years 2025, 2026 and 2017 and tax brackets. Clicking a link will open a new window.

The 2025 tax rates for married filing jointly and qualifying widow(er) are the same and are included below:

In 2025, it is $14,600 for single taxpayers and $29,200 for married taxpayers filing jointly, slightly increased from 2025 ($13,850 and $27,700).